LaTeX templates and examples — University

Recent

Base document for the Aumônerie INSA Toulouse documents, based on the template of the Club Info from the same school

A beamer template for Pennsylvania State University for College of Information Sciences and Technology. It is an extended version of the Berkeley Beamer Template

Pontifical Catholic University of Rio de Janeiro (PUC-Rio) Thesis and dissertation template ver1.0.11 - updated Jun/2020 Source: https://www.puc-rio.br/ensinopesq/ccpg/apresentacao_ted.html

Template for Bachelor and Master-Thesis, FH St. Pölten (2024)

【转载】原地址:https://github.com/fuujiro/DLUT-Beamer-Slide-V2

Honors Thesis Template for the University of Utah, created in 2024.

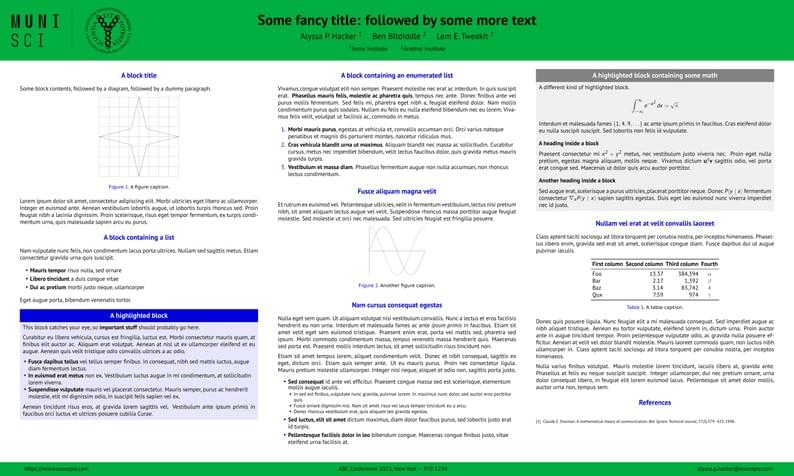

A Beamer poster template with Faculty of Science, Masaryk University, Brno logo and colors.

HEBUT(河北工业大学)本科毕业设计(论文)模板。GitHub 仓库地址为:https://github.com/LiuPeng-NGP/HEBUT-Thesis

University of Chicago beamer, modified on Xu Minghao's Ritsumeikan University version

Related Tags

- Portuguese

- Purdue University

- Queen's University Belfast

- Handout

- Bosnian

- International Languages

- TikZ

- Math

- References

- Algorithm

- Biber

- BibLaTeX

- Tables

- Czech

- Quiz, Test, Exam

- Universiti Utara Malaysia

- Conference Paper

- Conference Presentation

- Harvard University

- Tutorial

- Physics

- Source Code Listing

- Swedish

- French

- Portuguese (Brazilian)

- Greek

- Getting Started

- Research Diary

- Cover Letter

- Essay

- Exam

- Title Page

- Spanish

- German

- Radboud University

- Technological Educational Institute of Peloponnese

- LuaLaTeX

- Université d'Avignon

- Universiti Malaysia Sarawak

- Universiti Malaysia Perlis

- Newsletters

- Posters

- Instituto de Matemática, Estatística e Ciência da Computação (IME-USP)

- CVs and résumés

- Formal letters

- Assignments

- Cambridge University

- Instituto Federal de Educação Ciência e Tecnologia (IFCE)

- Imperial College London

- Korean

- Norwegian

- Polish

- University of Bergen

- Matrices

- Boise State University

- Bristol University

- Finnish

- Tampere University of Technology (TUT)

- Universiti Sains Malaysia

- Multimedia University (MMU)

- Beamer

- SENAC

- Universiti Malaya

- XeLaTeX

- Arabic

- University of Sarajevo

- Universiti Kebangsaan Malaysia

- Bahasa Malaysia (Malay)

- Two-column

- University of Texas at Austin

- Umeå University

- Queen Mary University of London

- Romanian

- Universiti Putra Malaysia

- Zagazig University

- Monterrey Institute of Technology and Higher Education

- Universiti Teknologi Malaysia

- University of Helsinki

- University of Copenhagen

- Reykjavík University

- University of Reading

- Universidad Nacional Autónoma de México

- University of Cape Town

- Peking University

- Universidad de Costa Rica

- Theses

- Books

- Presentations

- Reports

- Japanese

- Tilburg University

- Universidade Tecnológica Federal do Paraná (UTFPR)

- Cologne University of Applied Sciences (Fachhochschule Köln)

- Kyushu University

- Universidade Federal de Alagoas

- Slovenian

- University of Manchester

- Federal University of Bahia

- University of Tokyo

- Universidade Federal do Rio Grande do Sul

- Technion - Israel Institute of Technology

- Vietnamese

- Özyeğin University

- Keio University

- Stanford University

- Chinese

- Thai

- Universidade de Lisboa

- Brown University

- Princeton University

- New York University (NYU)

- Pontifícia Universidade Católica de Minas Gerais (PUC)

- Evaluation

- Indian Institute of Technology Madras

- Sociedade Brasileira de Computação (SBC)

- Universidade de São Paulo

- Uppsala University

- Universidade Estadual Paulista (UNESP)

- Geology

- Wright State University

- Catalan

- Universidad Autónoma de Occidente

- Instituto de Ciências Matemáticas e de Computação (USP)

- Strathmore University

- Kiel University of Applied Sciences

- University of Porto

- Auburn University

- University of Burgundy

- University of Girona

- Heriot-Watt University

- University of Tennessee

- Malcolm X Shabazz High School

- Pocono Environmental Education Center

- Cardiff University

- Florida State University

- Hebrew

- Tel Aviv University

- Bloomsburg University of Pennsylvania

- McMaster University

- Åbo Akademi University

- Faculdades Integradas Espírito-Santenses (FAESA)

- University of California, San Diego

- Universidad Nacional de Asunción

- Universitat Rovira i Virgili

- Pontificia Universidad Católica de Chile

- Meeting Minutes

- Universidade Estadual de Ponta Grossa (UEPG)

- Russian

- Moscow Aviation Institute

- Universidade Nova de Lisboa (UNL)

- Research Proposal

- Universidad Tecnológica de Bolívar

- Lehigh University

- Technische Universität Berlin

- University of Utah

- Universidad de Santiago de Chile

- Lecture Notes

- Instituto de Astronomia, Geofísica e Ciências Atmosféricas (IAG/USP)

- Aalborg University

- Dutch

- University of Birmingham

- Universidade Federal de Mato Grosso do Sul

- Ben-Gurion University of the Negev

- University of Amsterdam

- Instituto Superior de Engenharia de Lisboa (ISEL)

- Université de Sherbrooke

- University of California, Berkeley

- Southeast University

- University of Louisiana at Lafayette

- Adelphi University

- KTH Royal Institute of Technology

- Dr BR Ambedkar National Institute of Technology Jalandhar

- Sapienza - Università di Roma

- Universidade de Caxias do Sul

- Universidade do Estado do Rio de Janeiro

- Icelandic

- Universidade Federal de Ouro Preto

- Astronomy & Astrophysics

- Masaryk University

- abnTeX

- Cornell University

- Lund University

- Aberystwyth University

- Universidad Autónoma de Yucatán

- California Institute of Technology (Caltech)

- University of York

- Université de Sfax

- Katholieke Universiteit Leuven (KU Leuven)

- Virginia Tech

- Universiti Pertahanan Nasional Malaysia

- Universidade Federal Rural de Pernambuco

- Charles University in Prague (Univerzita Karlova v Praze)

- Welsh

- HIET Hamdard University

- Humanities

- Universidad de Sevilla

- University of California, Davis

- Queensland University of Technology

- Bahasa Indonesia

- University of Strathclyde

- Eskişehir Osmangazi University

- Universidade Estadual de Feira de Santana

- Turkish

- Universidade Federal de Santa Catarina

- Tecnológico Nacional de México

- Politechnika Śląska (Silesian University of Technology)

- American Psychological Association

- Universidade Federal de Goiás

- Sungkyunkwan University

- University of Victoria

- University of Alabama

- Duke University

- University of Bath

- RMIT

- TU Delft

- University of Ljubljana

- German University in Cairo

- Memorial University

- Instituto Superior de Engenharia do Porto

- Technische Universität Wien

- Linköpings Universitet

- University of Banja Luka

- Bangladesh University of Engineering and Technolog

- Ukrainian

- University of the West of England Bristol

- Fachhochschule der Wirtschaft

- Johns Hopkins

- Universidade de Fortaleza

- Université Laval

- Universidade do Vale do Rio dos Sinos

- Kocaeli Üniversitesi

- Universidad Católica San Pablo

- Universidad Nacional de Colombia (UNAL)

- University of Twente

- National University of Singapore (NUS)

- Universidad de Chile

- Universidade de Brasília (UnB)

- Unidad de Formación Masiva

- National Institute of Technology

- Birla Institute of Technology and Science

- Universidad Tecnológica Nacional

- University of Ghent (Universiteit Gent)

- Universidade Federal do Rio de Janeiro

- Tsinghua University

- Swiss Federal Institute of Technology in Zurich (ETH Zürich)

- Modern Language Association (MLA)

- Universiti Tun Hussein Onn Malaysia (UTHM)

- Chicago

- University of Maryland Baltimore County

- Universidade Federal da Paraíba (UFPB)

- Politecnico di Milano

- Boğaziçi University

- Leiden University

- IES San Mateo

- Universidade Federal do Rio Grande do Norte (UFRN)

- Slovak

- INSA

- Eastern Mediterranean University (EMU)

- Universidad La Salle (Mexico)

- Universidade Federal de Santa Maria

- University of Pennsylvania

- Universidad Zaragoza

- Universidade Paulista

- Georgia State University (GSU)

- University of Toledo

- Universidade Federal do Piauí (UFPI)

- Universiti Malaysia Sabah

- Faculdade do Piauí (FAPI)

- Letter

- University of Texas San Antonio

- Queen's University, Canada

- Medical University of Vienna

- Centro Federal de Educação Tecnológica de Minas Gerais (CEFET-MG)

- Universidade Federal do Triângulo Mineiro

- University of Nottingham

- University of Arizona

- Hungarian

- TU Graz

- University of Pretoria

- Italian

- University of Iceland

- University of Illinois

- Nanyang Technological University

- Beijing University of Chemical Technology

- Guangdong University of Technology

- Universidade do Minho

- East China Normal University

- Ludwig Maximilian University of Munich

- University of Essex

- Fachhochschule St. Pölten (St. Pölten University of Applied Sciences)

- University of Florida

- University of Calgary

- Instituto Nacional de Pesquisas Espaciais

- University of Western Australia

- University of Shanghai for Science and Technology (USST)

- Turabian

- University of Seoul

- Pacific University

- Bangor University

- Universidade Federal de Uberlândia (UFU)

- Univerzita Palackého v Olomouci (Palacký University Olomouc)

- Örebro University

- Edge Hill University

- Indian Institute of Technology Kharagpur

- University College London

- IT University of Copenhagen

- Eindhoven University of Technology (TU/e)

- Escola Politécnica da USP

- Universidade Estadual de Campinas (UNICAMP)

- Instituto Politécnico de Bragança (IPB)

- Escuela Politécnica Nacional

- Universidade Federal de Lavras

- Florida Institute of Technology

- Salahaddin University-Erbil

- Universidad Central

- TU Dresden

- Massey University

- University of Queensland

- Xi'an Jiaotong University

- Université de Bretagne Occidentale (UBO)

- University of Electronic Science and Technology of China

- Czech Technical University in Prague

- Instituto Federal de Educação, Ciência e Tecnologia da Bahia

- Otto-von-Guericke-Universität Magdeburg

- Arizona State University (ASU)

- Universidad de Antioquia

- University of Udine

- Boston University

- Universidad Autónoma de Nuevo León

- Humboldt-Universität zu Berlin

- University of Virginia

- University of Michigan

- VIT University

- Universidade de Pernambuco (UPE)

- Sigtunaskolan Humanistiska Läroverket (SSHL)

- Universidade Federal de Juiz de Fora

- Universidade Federal de Minas Gerais (UFMG)

- University of Illinois at Chicago

- Stockholm University

- Farsi (Persian)

- Northwestern Polytechnical University, China (西北工业大学)

- Universidade Federal de Itajubá (Unifei)

- University of Science and Technology of China (USTC)

- Vrije Universiteit Brussel (VUB)

- Universidad Autónoma de San Luis Potosí (UASLP)

- Universidad Autónoma de Chile

- Universitat Pompeu Fabra

- Universidad Politécnica de Puebla

- TU Chemnitz

- University of Waterloo

- SGH Warsaw School of Economics

- Harbin Institute of Technology

- Università degli studi di Napoli Federico II

- Aalto University

- University of Warwick

- Universiti Tunku Abdul Rahman (UTAR)

- North Dakota State University (NDSU)

- Universidade Federal do Pará (UFPA)

- University Teknology PETRONAS (UTP)

- KEA Copenhagen School of Design and Technology

- University of Edinburgh

- Universität Ulm

- University of Leeds

- Universidade Federal de Alagoas (UFAL)

- Indiana University – Purdue University Fort Wayne

- North Carolina State University (NCSU)

- Universidad de Guadalajara

- Politecnico di Torino

- Ritsumeikan University

- University of Newcastle

- University of Malta

- Iran University of Science and Technology (IUST)

- University of New South Wales

- Universidad Católica de Colombia

- Michigan Technological University

- Oregon State University

- University of Passau

- Università di Pisa

- Universidade da Coruña (UDC)

- University of Athens

- Trinity College Dublin

- Universidade Estadual de Santa Cruz

- University of Vienna

- University College Dublin

- Universidade da Beira Interior (UBI)

- National University of Mongolia

- Universidad Andres Bello

- Universidad de Córdoba

- University of Bonn

- University of Pittsburgh

- Université de Lorraine

- Instituto Tecnológico Vale

- University of Central Florida

- Universidad Simón Bolívar

- Universidad de Oviedo

- Maastricht University

- Instituto Modal

- University of Southampton

- Texas A&M University

- University Jaume I

- UPV/EHU

- Aveiro University

- University of Jyväskylä

- Singapore University of Technology and Design (SUTD)

- Universidad de Cádiz

- FH Aachen

- Universidad Industrial de Santander (UIS)

- University of Innsbruck

- American University of Beirut

- Universitat de Lleida

- New Mexico State University (NMSU)

- Instituto Federal de São Paulo

- Universidad de Extremadura

- TU Darmstadt

- Universidad Católica Boliviana "San Pablo"

- Cairo University

- Universidad Cooperativa de Colombia

- Universidad de Ingeniería y Tecnología

- Universita' degli Studi di Messina

- Luleå University of Technology

- Università degli Studi di Trento

- Teaching Plan & Syllabus

- Universidad de Tarapaca

- Dublin Business School

- Gyeongsang National University

- University of East London

- Creighton University

- Instituto Tecnológico de Buenos Aires

- ShanghaiTech University

- Universidade Federal do Ceará

- Universidade Federal de Pernambuco (UFPE)

- Universidad del Valle de Guatemala

- Augsburg University

- Instituto Tecnológico de Tuxtla Gutiérrez

- Università degli Studi del Sannio

- Žilinská univerzita v Žiline

- University of Hawaii

- Mississippi State University

- Instituto Tecnológico Autónomo de México

- Ohio State University

- Universidad Católica de la Santísima Concepción

- Universidad Nacional de San Agustín

- Technical University of Munich

- Kyungpook National University

- Universidade Federal do ABC

- Universidade de Trás-os-Montes e Alto Douro

- University of New Haven

- Pontifícia Universidade Católica do Rio de Janeiro

- National Institute of Technology, Kurukshetra

- Khalifa University

- Hasso-Plattner Institute

- Yale University

- Chalmers University of Technology

- Universidade Estadual da Região Tocantina do Maranhão

- Shanghai University of International Business and Economics

- Universidad Complutense de Madrid

- Centro Universitário da Grande Dourados

- Universidade Estadual do Ceará

- Dublin Institute of Technology

- Université Paul Valéry Montpellier 3

- Beijing University of Posts and Telecommunications

- University of Würzburg

- Curtin University

- Université de Neuchâtel

- University of the Balearic Islands

- University at Buffalo

- Universidad de Alicante

- Universidad Nacional del Callao

- Ho Chi Minh City University of Technology

- Friedrich-Alexander University Erlangen-Nürnberg

- Saint Martin's University

- University of Agder

- Alexandru Ioan Cuza University

- Fudan University

- Purdue University Fort Wayne

- Universidad de Murcia

- Westfälische Hochschule

- Memo

- Sveučilište u Rijeci (University of Rijeka)

- Georgia Institute of Technology

- University of Sydney

- Escola Tècnica Superior d’Enginyeria Industrial de Barcelona

- Utrecht University

- University of Oslo

- Universidad del Valle

- University of Cologne

- Emory University

- Carmelcollege Emmen

- Norwegian School of Economics

- University of Sheffield

- Northumbria University

- Huazhong University of Science and Technology

- Dublin City University

- Universidad Autónoma de Ciudad Juárez

- Universidad de Castilla - La Mancha

- Universidad Distrital Francisco José de Caldas

- Tampere University (TUNI)

- Beijing Institute of Technology

- Washington State University

- Technical University of Denmark

- Universitas Indonesia

- Erciyes University

- Middle East Technical University

- Université du Québec à Montréal

- Instituto Federal de Educação, Ciência e Tecnologia do Espírito Santo (IFES)

- Università di Catania

- Universidade Federal de Mato Grosso

- Okinawa Institute of Science and Technology

- George Washington University

- Yachay Tech University

- Manipal Institute of Technology

- University of Glasgow

- Jordan University of Science and Technology

- Aix-Marseille Université

- Taylor's University

- Ahsanullah University of Science and Technology

- Iowa State University

- University of Iowa

- Universität Rostock

- Gwangju Institute of Science and Technology

- University of Keele

- Zhejiang University

- Lanzhou University

- Kookmin University

- Universidade Federal do Paraná

- University of Groningen

- University of Durham

- University of Liverpool

- École de Commerce et École de Culture générale de Martigny

- Latvian

- Abertay University

- ENS Paris Saclay

- Universita degli Studi di Cagliari

- Politehnica University of Timișoara

- Mongolian

- Czech University of Life Sciences

- National Institute of Technology Rourkela

- University of L'Aquila

- University of Delaware

- HTL Pinkafeld

- University of Economics, Prague

- Aristotle University of Thessaloniki

- Nanjing University of Posts and Telecommunications

- University of Melbourne

- École Centrale de Lyon

- Universidade Federal dos Vales do Jequitinhonha e Mucuri

- National Taiwan University of Science and Technology

- City University of Hong Kong

- École Polytechnique Fédérale de Lausanne

- Charité – Universitätsmedizin Berlin

- Hochschule Furtwangen University

- University of Lincoln

- Northwestern University

- University of Oxford

- Università Politecnica delle Marche

- Vanderbilt University

- Technical University Dublin

- Khulna University

- McGill University

- Brno University of Technology

- Universität Duisburg-Essen

- Instituto Nacional de Telecomunicações (INATEL)

- University of Cuenca

- Universidad de las Fuerzas Armadas ESPE

- Northeastern University

- Universitat Politècnica de València

- University of New Mexico

- Akdeniz University

- Information Technology University (ITU)

- Universidad Católica del Norte en Antofagasta

- Universidad Tecnológica de Pereira

- Massachusetts Institute of Technology

- University of Information Technology (Vietnam)

- Universidad de Concepción

- Stellenbosch University

- Universidad Internacional de la Rioja

- University of Bremen

- Shanghai Jiao Tong University

- Hochschule Darmstadt

- TOBB University of Economics & Tchnology

- Universidad Nacional De San Cristóbal de Huamanga

- Marmara University

- Warsaw University of Technology

- National College of Ireland

- University of Alberta

- Universidad Autónoma de Zacatecas

- Universiti Teknologi MARA (UiTM)

- Norwegian University of Science and Technology

- Poznán University of Economics and Business

- Uniwersytet Pedagogiczny

- Manchester Metropolitan University

- ENET'Com

- Pontifical Catholic University of São Paulo

- Sheffield Hallam University

- Universidad Nacional del Altiplano

- Universidade Federal de São Paulo

- Universidad Central de Venezuela

- Instituto Plurilingüe Rosalia de Castro

- University of Málaga

- University of Surrey

- Escola Superior de Tecnologia e Gestão

- Kyoto University

- Skolkovo Institute of Science and Technology

- Cyprus University of Technology

- Università Roma Tre

- Fatih Sultan Mehmet Foundation University

- Tecnológico de Monterrey

- Xiamen University

- Wuhan University

- University of Turin

- Karlsruhe Institute of Technology

- Chulalongkorn University

- Alpen-Adria University Klagenfurt

- Università degli Studi di Salerno

- Univerza v Mariboru

- Universidade da Coruña

- University of California, Irvine

- Open University of Israel

- Sorbonne Université

- University of Southern Denmark

- Tokyo Metropolitan University

- Instituto Tecnológico de Morelia

- University of West Attica

- Mid Sweden University

- University of Macau

- University of Chinese Academy of Sciences

- University of Stuttgart

- Jagiellonian University

- Centro Federal de Educação Tecnológica de Rio de Janeiro (CEFET-RJ)

- Università degli Studi di Pavia

- Pontificia Universidad Católica del Perú

- Erciyes University

- Eötvös Loránd University

- Universidade Estadual de Londrina

- University of Idaho

- National Taiwan University

- Taras Shevchenko National University of Kyiv

- Edinburgh Napier University

- Universidad Nacional de Ingeniería

- Nankai University

- TU Dortmund

- Colorado School of Mine

- Poznan University of Technology

- Università della Calabria

- Hakim Sabzevari University

- Stony Brook University

- Università di Padova

- Georgia Southern University

- Politehnica University of Bucharest

- Universidade Federal de Pelotas

- Mälardalen University

- Indian Institute of Management Indore

- Universidad Internacional de Valencia

- Hamad Bin Khalifa University

- Universidade Federal do Amazonas

- Institut de physique du globe de Paris

- Qatar University

- Universidade Federal do Maranhão

- Albert-Ludwigs-Universität Freiburg

- Universidad de Buenos Aires

- Yıldız Teknik Üniversitesi

- Oslo Metropolitan University

- Renmin University of China

- Dalian Maritime University

- Coventry University

- Universidad Nacional Pedro Ruiz Gallo

- University of Limerick

- Tallinn University of Technology

- Soochow University

- National Sun Yat-sen University

- Hong Kong University

- Ain Shams University

- Universidad Central del Ecuador

- University of Lancaster

- Karlstad University

- Univerzita Hradec Králové

- Hochschule Heilbronn

- University of Zurich

- Basque

- Brunel University

- LUT University

- Universidad Politécnica de Madrid

- University of Szeged

- University of Patras

- University of Tsukuba

- APJ Abdul Kalam Technological University

- Project Plan

- Universiti Teknikal Malaysia Melaka

- University of Warsaw

- International Hellenic University

- Saarland University

- Instituto Politécnico Nacional

- IST Austria

- Chinese Southern University

- King's College London

- HSLU

- IIT Delhi

- University of Tartu

- Pontificia Universida Javeriana

- Federal University of São João del-Rei

- Brussels Faculty of Engineering

- Ahsanullah University of Science and Technology

- Tulane University

- IISER Thiruvananthapuram

- University of Liechtenstein

- Virginia Tech

- University of Dayton

- ENS Lyon

- University of Windsor

- King Abdullah University of Science and Technology

- University of Thessaly

- Brigham Young University

- Isra University

- Università di Foggia

- University of Münster

- Indiana University

- University of Puerto Rico

- Howard University

- Monash University

- University of Massachusetts Amherst

- UC3M

- Universidad Carlos III de Madrid

- Université de Lille

- University of Toronto

- University of Chicago

- Chinese University of Hong Kong

- Universidad Técnica Particular de Loja

- Universidad de La Laguna

- IIT Patna

- Université Paris-Saclay

- Hanoi University of Science and Technology

- Sofia University

- Brandeis University

- COMSATS University Islamabad

- University of Washington

- Universidade Federal do Espírito Santo

- Programa de Pós-Graduação em Engenharia Elétrica

- Somaiya Vidyavihar University

- Bulgarian

- Telkom Universuty

- Instituto Federal do Pará

- South China Normal University

- Malmö University

- ITMO University

- Beijing Forestry University

- UNIVERSIDADE ESTADUAL VALE DO ACARAÚ

- Seoul National University

- Williams College

- University of Fribourg

- Universidade Federal do Recôncavo da Bahia

- Jinan University

- Université Paris Nanterre

- Instituto Federal do Rio de Janeiro

- Sergio Arboleda University

- Normandie Université

- National Tsing Hua University

- University of Engineering & Technology Lahore

- Nitte Meenakshi Institute of Technology

- University of Cantabria

- Vrije Universiteit Amsterdam

- Yonsei University

- Jiangxi Normal University

- University of Kentucky

- Universidad ECCI

- Universidad Nacional de Moquegua

- National Cheng Kung University

- University of British Columbia

- University of Durham

- Hong Kong Polytechnic University

- Anna University

- DuyTan University

- OSU Official

- Université de Mons

- Erasmus School of Economics

- Hong Kong University of Science and Technology

- University of Djelfa

- Université Paris Cité

- La Trobe University

- Southern Methodist University

- Université libre de Bruxelles (ULB)

- Galician

- Journal articles

- Bibliographies

\begin

Discover why over 25 million people worldwide trust Overleaf with their work.