Abhinay Korukonda's Resume

Author:

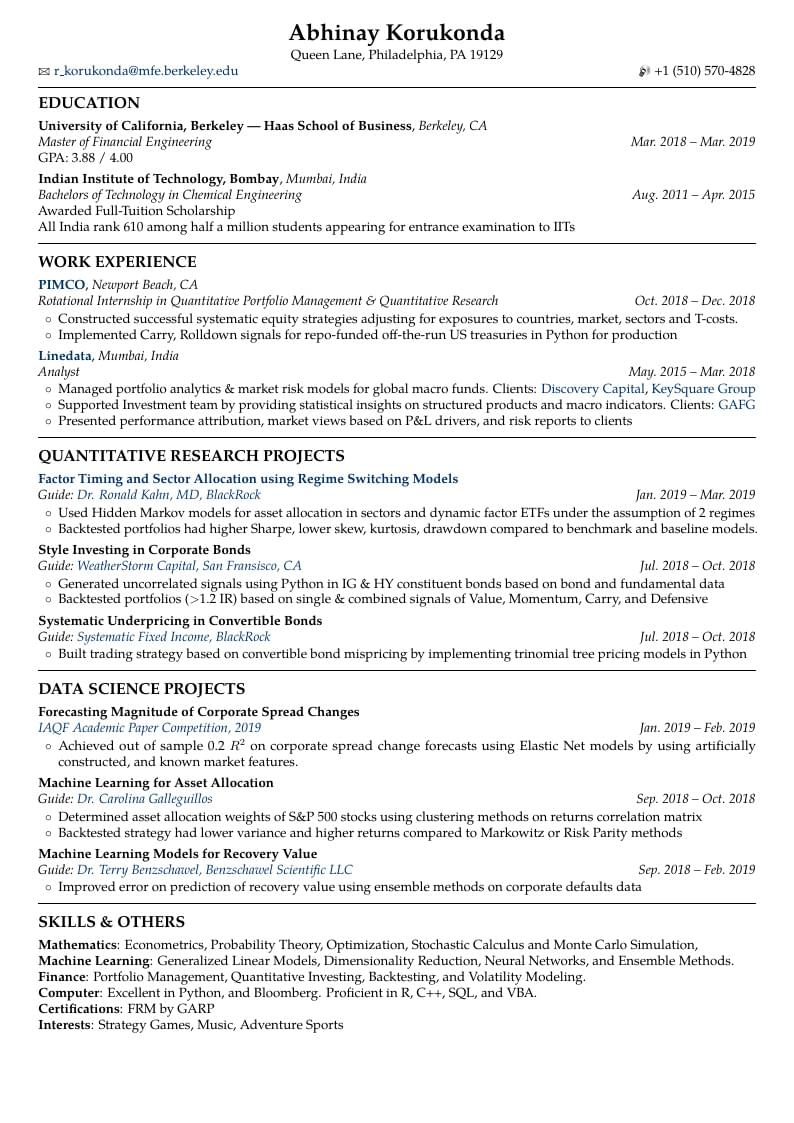

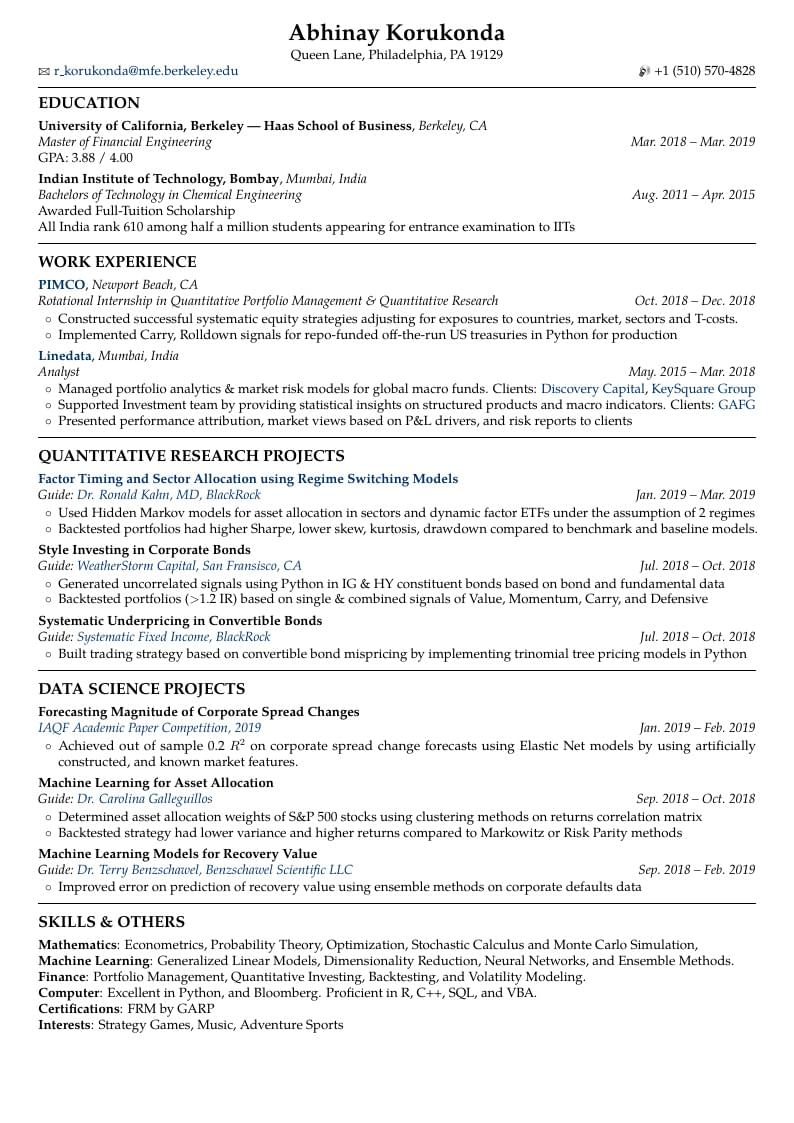

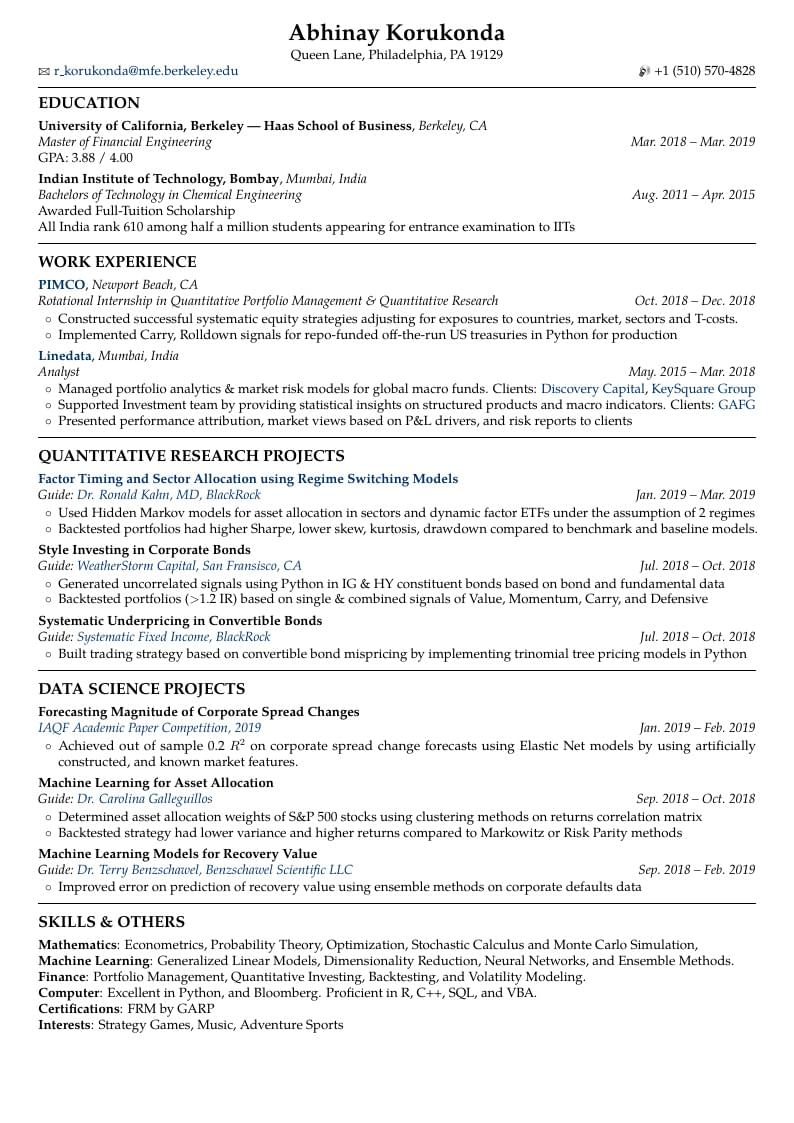

Abhinay Korukonda

Last Updated:

7 years ago

License:

Creative Commons CC BY 4.0

Abstract:

Abhinay Korukonda's Resume

\begin

Discover why over 25 million people worldwide trust Overleaf with their work.

Abhinay Korukonda's Resume

\begin

Discover why over 25 million people worldwide trust Overleaf with their work.

\documentclass[10pt]{article}

\usepackage[a4paper, left=0.40in, right=0.40in, top=0.25in, bottom=0.15in]{geometry}

\usepackage[utf8]{inputenc}

\usepackage[english]{babel}

\hyphenation{Some-long-word}

\usepackage{resume}

\begin{document}

\begin{center}

\textbf{\LARGE Abhinay Korukonda}\\[0.5ex]

\textscale{1.05}{Queen Lane, Philadelphia, PA 19129\\

\Letter\hspace{0.1ex} \href{mailto:r_korukonda@mfe.berkeley.edu}{r\_korukonda@mfe.berkeley.edu}

\hfill

\Mobilefone\hspace{0.1ex} +1 (510) 570-4828}

\end{center}

\spacedhrule{-1.0ex}{-0.5ex}

\roottitle{EDUCATION}

\headedsection

{University of California, Berkeley | Haas School of Business}

{Berkeley, CA}

{Master of Financial Engineering}

{\period{Mar}{2018}{Mar}{2019}}

{GPA: 3.88 / 4.00}

\headedsection

{Indian Institute of Technology, Bombay}

{Mumbai, India}

{Bachelors of Technology in Chemical Engineering}

{\period{Aug}{2011}{Apr}{2015}}

{Awarded Full-Tuition Scholarship\\

All India rank 610 among half a million students appearing for entrance examination to IITs}

\spacedhrule{0.8ex}{0.0ex}

\roottitle{WORK EXPERIENCE}

\headedsection

{\href{https://www.pimco.com/en-us/}{PIMCO}}

{Newport Beach, CA}

{Rotational Internship in Quantitative Portfolio Management \& Quantitative Research}

{\period{Oct}{2018}{Dec}{2018}}{

\vspace{-2.4ex}

\begin{circlist}

\item Constructed successful systematic equity strategies adjusting for exposures to countries, market, sectors and T-costs.

\item Implemented Carry, Rolldown signals for repo-funded off-the-run US treasuries in Python for production

\end{circlist}

}

\headedsection

{\href{https://www.linedata.com/}{Linedata}}

{Mumbai, India}

{Analyst}

{\period{May}{2015}{Mar}{2018}}

{\vspace{-2.4ex}

\begin{circlist}

\item Managed portfolio analytics \& market risk models for global macro funds. Clients: {\href{https://www.bloomberg.com/news/articles/2018-06-12/citrone-s-discovery-strikes-a-comeback-with-italian-short-wager}{Discovery Capital}}, {\href{https://www.businessinsider.com/scott-bessent-launches-key-square-group-2016-1}{KeySquare Group}}

\item Supported Investment team by providing statistical insights on structured products and macro indicators. Clients: {\href{https://www.globalatlantic.com/}{GAFG}}

\item Presented performance attribution, market views based on P\&L drivers, and risk reports to clients

\end{circlist}

}

\spacedhrule{0.8ex}{0.0ex}

\roottitle{QUANTITATIVE RESEARCH PROJECTS}

\headedsectiontwo

{\href{https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3359464}{Factor Timing and Sector Allocation using Regime Switching Models}}{\period{Jan}{2019}{Mar}{2019}}

{\href{https://www.blackrock.com/institutions/en-us/biographies/ronald-kahn}{Dr. Ronald Kahn, MD, BlackRock}}

{\vspace{-2.4ex}

\begin{circlist}

\item Used Hidden Markov models for asset allocation in sectors and dynamic factor ETFs under the assumption of 2 regimes

\item Backtested portfolios had higher Sharpe, lower skew, kurtosis, drawdown compared to benchmark and baseline models.

\end{circlist}

}

\headedsectiontwo

{Style Investing in Corporate Bonds}{\period{Jul}{2018}{Oct}{2018}}

{\href{http://www.weatherstormcapital.com/}{WeatherStorm Capital, San Fransisco, CA}}

{\vspace{-2.4ex}

\begin{circlist}

\item Generated uncorrelated signals using Python in IG \& HY constituent bonds based on bond and fundamental data

\item Backtested portfolios ($>$1.2 IR) based on single \& combined signals of Value, Momentum, Carry, and Defensive

\end{circlist}

}

\headedsectiontwo

{Systematic Underpricing in Convertible Bonds}{\period{Jul}{2018}{Oct}{2018}}

{\href{https://www.blackrock.com/us/individual/investment-ideas/systematic-fixed-income}{Systematic Fixed Income, BlackRock}}

{\vspace{-2.4ex}

\begin{circlist}

\item Built trading strategy based on convertible bond mispricing by implementing trinomial tree pricing models in Python

\end{circlist}

}

\spacedhrule{0.8ex}{0.0ex}

\roottitle{DATA SCIENCE PROJECTS}

\headedsectionthree

{Forecasting Magnitude of Corporate Spread Changes}{\period{Jan}{2019}{Feb}{2019}}

{\href{https://www.iaqf.org/}{IAQF Academic Paper Competition, 2019}}

{\vspace{-2.4ex}

\begin{circlist}

\item Achieved out of sample 0.2 $R^2$ on corporate spread change forecasts using Elastic Net models by using artificially constructed, and known market features.

\end{circlist}

}

\headedsectiontwo

{Machine Learning for Asset Allocation}{\period{Sep}{2018}{Oct}{2018}}

{\href{https://www.linkedin.com/in/carolinagalleguillos/}{Dr. Carolina Galleguillos}}

{\vspace{-2.4ex}

\begin{circlist}

\item Determined asset allocation weights of S\&P 500 stocks using clustering methods on returns correlation matrix

\item Backtested strategy had lower variance and higher returns compared to Markowitz or Risk Parity methods

\end{circlist}

}

\headedsectiontwo

{Machine Learning Models for Recovery Value}{\period{Sep}{2018}{Feb}{2019}}

{\href{https://www.linkedin.com/in/terry-benzschawel-64998413/}{Dr. Terry Benzschawel, Benzschawel Scientific LLC}}

{\vspace{-2.4ex}

\begin{circlist}

\item Improved error on prediction of recovery value using ensemble methods on corporate defaults data

\end{circlist}

}

\spacedhrule{0.8ex}{0.0ex}

\roottitle{SKILLS \& OTHERS}

\begin{indentsection}

\skill{Mathematics}{Econometrics, Probability Theory, Optimization, Stochastic Calculus and Monte Carlo Simulation, }

\skill{Machine Learning}{Generalized Linear Models, Dimensionality Reduction, Neural Networks, and Ensemble Methods.}

\skill{Finance}{Portfolio Management, Quantitative Investing, Backtesting, and Volatility Modeling.}

\skill{Computer}{Excellent in Python, and Bloomberg. Proficient in R, C++, SQL, and VBA.}

\skill{Certifications}{FRM by GARP}

\skill{Interests}{Strategy Games, Music, Adventure Sports}

\end{indentsection}

\end{document}